Financial Crime in a Disrupted Global Environment

Albert Einstein famously said: “In the midst of every crisis, lies great opportunity,” and criminals got a little too inspired by the sentiment.

Since time immemorial, the financial services sector has been at the receiving end of various risks ranging in magnitudes. In contemporary times, there is perhaps nothing as disconcerting as the risk of financial crimes.

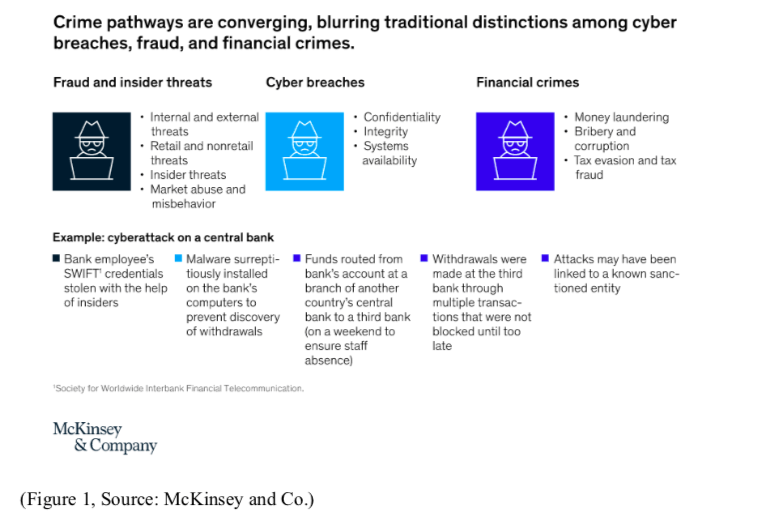

Financial crimes have an impact on large and small entities alike and include a broad spectrum of violations, including internet phishing, money laundering, identity fraud, terrorist financing, and tax evasion. This trillion-dollar threat has profound repercussions, and combating it is an unenviable task for all participants in the global financial economy.

Furthermore, COVID-19 has brought the world to the forefront of the fight against financial crime and led institutions to turbocharge what had generally been a glacial stroll towards remote working, the paramount concern remains to ensure safe access to data. Around the world, many have seized the opportunity presented by the crisis to exploit the antecedent vulnerabilities of an already distressed financial system, leading to even common concerns being exacerbated by extraordinary circumstances.

On a micro level, there are broadly two types of financial crime. Firstly, activities that dishonestly generate wealth for those engaged in the act in question. For instance, exploitation of insider information or acquisition of another person’s property by deceit, done with the intention of securing a material benefit. Secondly, there are activities where there is no direct involvement of such dishonest gain but rather protection or facilitation of such unethical rewards. An example of such an act can be someone who attempts to launder the criminal proceeds of another offence in order to place the revenue beyond the reach of the law.

Anecdotal evidence suggests a rise in financial crime, including money laundering and rogue trading, during the pandemic. Opportunities for perpetrating cyber-enabled crimes have also increased, and data shows an exponential surge in cyber attacks over baseline levels.

Not even the most extreme scenarios would ever have envisaged a global lockdown with such high levels of online activity over such a period and subject to such high degree of uncertainty, as in the present time.

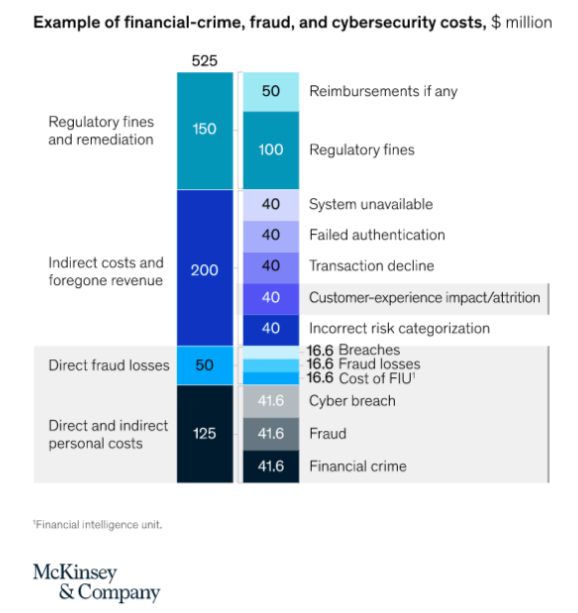

Translating the financial threat into quantitative terms, the United Nations estimates that the annual cost of money laundering and associated crimes is $1.4-3.5 trillion, out of which banks are only able to put a stop to less than a percent. Regulators have fined the world’s biggest banks more than $320 billion for breaches to date.

Each of the world's largest banks spends $1 billion annually on financial crime operations, with most of this amount being allocated to compliance rather than actively targeting the aforementioned criminal activities.

This considerable spending corresponds to an ever more growing onus on institutions to know precisely who their benefactors are and where their money is coming from. This situation also imposes enormous ramifications on cyber resilience capabilities at financial institutions and third-party technology service providers.

The industry has been making progress towards adopting a common cyber lexicon, implementing a robust cybersecurity framework, and enhancing international cooperation. Banks and financial institutions are employing new technologies and approaches to detect financial crime, which is highly appreciated by regulators and consumers alike.

Banks can now automate and improve their Know Your Customer (KYC) and Suspicious Activity Reporting (SAR) processes using Robotic Process Automation (RPA), Artificial Intelligence, and other newer technologies; they can use these nextgen technologies and capabilities to review scenarios and spot money laundering, insider trading and other illicit activities via identifying suspicious behaviour, reducing the number of false positives and improving the response time.

Nonetheless, before they can use these technologies effectively, institutions need to upgrade their data and advanced behavioural analytics capabilities to lay a stronger foundation for success.

To assess other facets of financial crime, it is essential to monitor the growth in the payments space, which is primarily driven not only by a renewed focus on customer-centricity but also by offering a plethora of novel payment options, including digital wallets, cross-border payments, cryptocurrencies and other financial technologies which reduce payment friction and support transactions through the use of blockchain. These payment methods have brought forth new financial crime risks that existing regulations and infrastructure are not equipped to address.

Owing to the new wave of digital transformation, vulnerabilities manifest in tandem with advancements in technologies. These are explicitly apparent in cross-border transactions and between multiple economies governed by a varied spectrum of lax to stringent regulatory requirements.

Anyhow, the baseline expectations of regulators are that institutions must ensure market integrity, effective customer due diligence processes, and ongoing monitoring, specifically concerning counter-financing of terrorism (CFT), and anti-money laundering (AML) norms.

As a consequence, the financial crime compliance dimension is on the cusp of transformation. There is increasing recognition of the need to innovate towards a more agile, efficient, and resilient approach to compliance of financial crime regulations and proactive targeting of criminal behaviour.

The offshoring of activities in financial services, either to captives or by outsourcing them to third parties, has also witnessed a turbulent trend during the pandemic. Many organisations offshore their AML and related financial crime prevention processes like transaction monitoring, alert management, and customer due diligence to managed service partners in emerging markets.

The critical criteria for choosing a location for offshoring remains political stability, availability of competent labour and technology at low costs. However, offshoring hubs such as India have revealed pitfalls in offshoring/outsourcing models, owing to the stringent lockdowns that have prompted institutions to consider bringing their financial crime functions back in-house while aggressively pursuing their use of digital tools to reduce manual effort.

Moreover, while offshoring may be cost-effective, it is often suboptimal for achieving the objective of preventing financial crime, partly due to the additional risks of complex and intransparent offshore structures, dispersed responsibilities, and lack of power to enforce technical control.

The Bank for International settlements (BIS) suggests that firms can reduce risks by taking steps to draw up clear outsourcing policies, and establishing effective risk management programmes.

Despite all the challenges mentioned above, the pandemic has presented an opportunity for criminals to commit extraordinary amounts of financial crime; as regulatory pressures continue to mount and new entrants render the marketplace more competitive. There is a newfound prerequisite of the agility context of this industry.

Luckily, there seems to be newfound cognisance that a reactive response to crime and compliance requirements is not the way of the future, as it is costly and suboptimal.

There needs to be a proactive approach to detect, prevent and mitigate threats using enhanced data and analytics capabilities. The integration of fraud and cybersecurity operations is a crucial step, given their interrelation. To maintain a competitive advantage, financial crime officers need to pursue strategic investments in offshoring and outsourcing.

Consequently, if this world presents criminals an opportunity amidst the crisis, it provides crime regulators with a more significant opportunity to improve and uplift themselves to emerge victorious.

Subscribe to The Pangean

Get the latest posts delivered right to your inbox